After historic floods in October 2015, residents of the Shadowmoss neighborhood in Charleston, South Carolina determined they’d had sufficient and had been able to maneuver elsewhere, out of harms approach. In response, Charleston officers utilized to the Federal Emergency Administration Agency (FEMA) for larger than $10 million to purchase out 48 properties.

Little did the residents of Shadowmoss (or metropolis officers) know that 4 years would go by prior to this effort could also be achieved. Charleston’s software program program for funding wasn’t permitted by FEMA till October 2017. After the requisite opinions had been lastly achieved, your entire properties had been bought, nonetheless demolition was not achieved till the summer time season of 2019. Contained in the meantime, the neighborhood had professional a complete of 4 necessary flooding occasions in three years.

Such waits are all too typical, with the overwhelming majority of FEMA-financed buyout initiatives taking larger than 5 years to finish. These delays are a serious impediment to the issue to maneuver of us out of the rising variety of areas inclined to flooding, rising sea ranges, and completely completely different outcomes of native local weather change.

What the residents of Shadowmoss professional is what passes for managed retreat presently throughout the US. Managed retreat is a long-term course of that options the deliberate unbuilding of inclined areas and the following relocation of individuals, properties, corporations, and infrastructure. As native local weather change will enhance the hazards of flooding, sea diploma rise, and completely completely different hazards, additional of us will want such help to relocate, and there could also be an rising urgency to produce it, typically contained in the sort of buyouts.

There’s an infinite hole between what FEMA’s capabilities could assist and the variety of of us additional extra more likely to need and want a buyout.

However the present federal safety, planning, and financing processes that help dwelling buyouts are time-consuming, rife with uncertainty, and stuffed with ambiguity, and will depart of us in purgatory.

FEMA is (and would possibly proceed to be) one among many foremost sources of buyout funding, nonetheless its capabilities are already struggling to produce buyouts in a successfully timed growth contained in the aftermath of presently’s flood disasters.

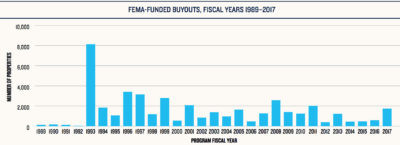

Over the sooner 30 years, FEMA has supported buyouts of upper than 43,000 properties. At that tempo, FEMA’s present capabilities would help about 130,000 additional buyouts over the following 90 years. However that’s a drop contained in the bucket in contrast with the projected 13.1 million People who could even see their properties inundated by six ft of sea diploma rise in coastal areas by the tip of the century. And a complete bunch of lots of additional alongside the nation’s rivers and inland floodplains would possibly must maneuver out of more and more extra flood-prone areas as excessive precipitation occasions improve.

Given native local weather forecasts, the present scale and tempo of buyouts leaves an infinite hole between what FEMA’s present capabilities can realistically help and the variety of of us additional extra more likely to need and want a buyout with a view to relocate to safer areas.

A for-sale signal inside the doorway yard of a house broken by flooding from Hurricane Florence in Conway, South Carolina in February 2019.

AP {{Photograph}}/Sean Rayford

Of their present variety, FEMA’s capabilities are usually not able to scaling as quite a bit as ship the wanted help. And if these are the right gadgets the nation has to conduct managed retreat, then managed retreat will, fairly frankly, be unmanageable.

Amongst completely completely different factors, what’s wanted is a elementary shift in pondering. Many federal, state, and native officers have labored tirelessly on buyout initiatives, nonetheless too typically these are executed as one-and-done efforts. Localities apply for funding, buyouts are achieved, and the grants are closed. Classes realized are usually not utilized to the following mission, due to every there isn’t a subsequent mission in that group or what was realized has been forgotten by the aim the following mission happens. The way in which through which whereby many communities and states conduct these initiatives is tantamount to re-inventing the wheel each time. This inefficient cycle is efficiently described by Alex Greer and Sherri Brokopp Binder of their aptly titled analysis paper, “A Historic Evaluation of Dwelling Buyout Safety: Are We Studying or Merely Failing?”

In exact actuality, inclined communities and states ought to transition from conducting buyout “initiatives” to administering buyout “capabilities” which can be guided by long-term pondering, cautious planning, true group engagement, and a handle fairness. Analysis has discovered that these initiatives are usually carried out by whiter, wealthier communities, who’ve the aptitude to take care of the tactic of conducting buyouts utilizing FEMA funding and leaping through the pretty a few bureaucratic hoops concerned.

We wish capabilities which can be in a position to operate at a tons bigger scale and on a tons quicker timeline that’s in step with native local weather projections and the managed retreat that could be required.

A timeline of FEMA-funded buyouts over the sooner 30 years. Buyouts peaked in 1993 following historic flooding contained in the U.S. Midwest.

My group on the Pure Property Security Council (NRDC) has examined buyout capabilities that used FEMA funding contained in the U.S., which, over the sooner three a really very long time, have totaled larger than 43,000 properties and three,839 buyout initiatives in 1,016 counties in 49 states. Along with addressing points with timeliness and fairness, one completely different key disadvantage helps smaller communities, which might uncover buyouts to be daunting. Dennis Knobloch, the sooner mayor of Valmeyer, Illinois (a gaggle that relocated out of the Mississippi River floodplain after the Good Flood of 1993) parts out that “wandering through the myriad of presidency insurance coverage protection insurance coverage insurance policies requires a full-time employees, and most small communities with part-time elected and appointed officers are usually not geared up for such an endeavor.”

Because of the federal authorities and communities face the prospect of managed retreat, they’re going to look to quite a few worthwhile buyout initiatives. One among them is New Jersey’s Blue Acres program. Began in 1995, it makes use of devoted state funding, employees, and sources to conduct buyouts on behalf of the state and native communities. It leverages federal {{{dollars}}} as soon as they’re accessible. After Hurricane Sandy hit in 2012, this method expanded its efforts significantly. As of final September, Blue Acres has spent $375 million on buyouts to buy virtually 1,000 properties. The same old buyout takes six to 12 months from begin to shut, with demolition of the property six to12 months after that.

Positioned just about 200 miles from the coast, the world spherical Charlotte, North Carolina has flooding that’s typically linked to the inland outcomes of coastal storms. Since 1999, Charlotte-Mecklenburg Storm Water Suppliers (SWS) has bought 460 properties at a value of $67 million. Pissed off with the tactic of securing FEMA grants for buyouts, SWS created its personal self-financed buyout program that’s supported virtually fully by native stormwater bills; it in the meanwhile spends about $4 million yearly. Now buyouts are achieved in a comparatively fast and environment nice course of which is able to take just some months to finish.

Many householders cease because of the years go they usually proceed to dwell with the specter of 1 completely different flood damaging their properties.

The capabilities in New Jersey and North Carolina reveal two key components in worthwhile buyouts: making sure the choice is launched quickly after a flood and guaranteeing that the acquisition of an individual’s dwelling occurs shortly as shortly because the tactic is about in movement. As Valmeyer’s former mayor Knobloch recounts, “Individuals who have misplaced their properties and corporations are searching for choices as quickly as attainable.”

For these fascinated a few buyout, many merely cease because of the months and years go by they usually proceed to dwell with the prospect, and sometimes the precise truth, of 1 completely different flood damaging their properties. That’s been the expertise of 1000’s of house owners in Houston and Harris County, Texas contained in the aftermath of 2017’s Hurricane Harvey, which killed 68 of us, led to $125 billion in damages, and destroyed or broken an estimated 204,000 properties.

An investigation by the Houston Chronicle discovered that individuals opted to promote their flooded properties to express property speculators for a fraction of their pre-flood worth due to they couldn’t bear to dwell with the trauma of flooding as quickly as additional. Many had utilized for a publicly financed buyout, nonetheless couldn’t await it to materialize. The consequence has been a misplaced completely different to completely take away properties from at-risk areas. Instead, a harmful sport of musical chairs is perpetuated, the place one proprietor leaves after taking a loss on the home and one completely different strikes in. The one winner is the speculator who made a revenue flipping a flood-prone property.

Irrespective of these challenges, flood-weary residents are nonetheless asking for buyouts, and localities try to make them an choice. In February 2020, six states are anticipated to have utilized for his or her share of $6.875 billion in federal native local weather resilience funding accessible from the Division of Housing and Metropolis Enchancment (HUD). Most of these states, if not all of them, are dedicating sizable components of that funding for buyouts. However as in the meanwhile proposed, these will look similar to the buyouts we’re all too accustomed to. They’re being supplied months, or years, after a flood catastrophe. They usually’ll be pursued as one-off initiatives which will buy properties after which shut up retailer. Few of those states are creating the long-term experience needed to hold out a program that outlives the supply of HUD’s funding. And that’s an infinite missed completely different.

A house in Sayreville, New Jersey being demolished in 2014 as a part of the state’s Blue Acres buyout program.

Rosanna Arias/FEMA

Buyouts are only one piece of the managed retreat puzzle, nonetheless they’re a significant one. If we aren’t in a position to present successfully timed and equitable help to those that want it to maneuver out of hurt’s approach, then we don’t have managed retreat – it’s additional similar to a home refugee disaster.

And we can be seeing the primary indicators of that. Consistent with the Inside Displacement Monitoring Centre, 1.25 million People had been displaced by disasters in 2018 alone. Whereas most of those displacements had been non eternal, tens of 1000’s of individuals throughout the US have been completely displaced by climate-driven disasters.

No particular person wins with a lot of these large-scale, unplanned displacements. Positively not the people displaced, who’ve left their properties and communities behind. However the communities who lose residents are furthermore diminished by the scarcity of workforce and expertise, of taxpayers and neighbors. Communities that acknowledge the long-term challenges related to native local weather change and take proactive steps to adapt could also be significantly larger in a position to retain inhabitants whereas shifting residents away from hazard.

True managed retreat efforts should embrace three widespread selections. First, most individuals acquisition and unbuilding of inclined areas. Second, re-establishing of us, properties, and corporations in safer areas, ideally throughout the an an identical or an adjoining group. And, lastly, the re-use of the newly acquired public lands for initiatives that additional decrease dangers, resembling rebuilding or restoring wetlands, and that present entry to inexperienced dwelling.

With out such reforms, the nation’s buyout efforts will proceed to fall transient of what’s going on to be wanted inside the approaching a really very long time.

NRDC, the place I work, has been pushing new concepts for buyouts which can make them additional equitable and extra environment nice, together with reforming the Nationwide Flood Insurance coverage protection safety Program to permit it to supply successfully timed buyouts to property homeowners when it doesn’t make sense to rebuild many events.

Until such reforms are enacted and completely completely different enhancements made, the nation’s buyout efforts will proceed to fall transient of what’s going on to be wanted inside the approaching a really very long time. And which will depart property homeowners terribly inclined, pressured to battle for the sources they should get out of hurt’s approach.

Such was the case for Olga McKissic after her Louisville, Kentucky dwelling flooded fairly a number of conditions. “After the April 2015 flood,” she talked about, “that’s after I knew: ‘I’m not going to cease till I get this buyout. You’re going to know who I’m, and likewise you’re going to truly actually really feel my ache, and likewise you’re going to see my face.’ I wasn’t merely combating for myself. I used to be combating for my neighbors, too. Anybody on my avenue had already obtained a buyout, so I knew it was attainable.”

She obtained one in November 2018, nonetheless not till her dwelling had flooded a fifth time whereas she waited to hunt out out if FEMA would approve the grant that allowed her dwelling to be bought.

A Houston neighborhood flooded contained in the wake of Hurricane Harvey in August 2017.

Marcus Yam / Los Angeles Conditions via Getty Photographs

It shouldn’t be a grueling course of to get help to relocate to larger floor, considerably when it could be extra economical to taxpayers to supply a buyout, moderately than having the Nationwide Flood Insurance coverage protection safety Program pay to rebuild a property many times. FEMA, which gives the overwhelming majority of economic help for buyouts, is aware of the issue. Contained in the aftermath of Hurricane Harvey, Roy Wright (then a FEMA deputy affiliate administrator) talked about, “I’m working with my group and attorneys on methods I can swap [buyouts] to the doorway. The intention is, I’m not going to pay anybody to redo their residence, then re-buy it.”

However that’s precisely what FEMA is required to do — pay anybody to redo their residence, then re-buy it later — beneath the present insurance coverage protection insurance coverage insurance policies and capabilities that we now have to depend upon to help managed retreat.

Instead we’d want to have the pliability to current the number of a buyout as quickly as a flood occurs, or better nonetheless, months or years prior to the following flood happens. To try this, communities, states, and the federal authorities want to acknowledge the necessity for a managed retreat technique. That takes foresight and planning, and it requires communities to start having conversations concerning the longer term and the alternate options that they need need to make accessible to their residents.